Los Feliz vs. Silver Lake: Which Neighborhood Is Right for You?

Introduction: A Tale of Two Trendy Neighborhoods Los Feliz and Silver Lake are two of the most desirable neighborhoods in Los Angeles. They sit side by side, share creative energy, and offer incredible dining, culture, and architecture. But while they’re close neighbors, each community has its own u

Read MoreLos Feliz Real Estate Market Update 2025

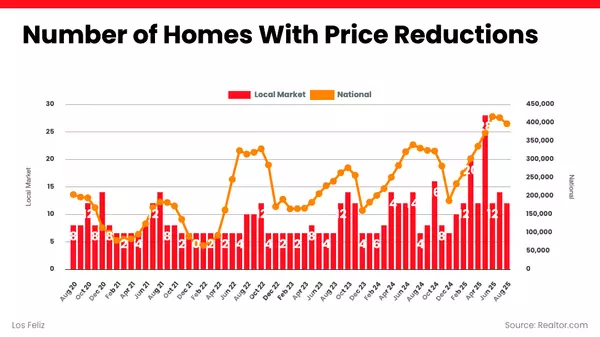

Introduction: Why Market Insights Matter Real estate isn’t just about homes — it’s about timing. If you’re considering buying, selling, or investing in Los Feliz, understanding today’s market conditions is crucial. At Rooster Homes, we provide a data-driven, education-first approach, so our clients

Read MoreThe Complete History of Los Feliz: From Ranch Land to Hollywood Haven

Introduction: Why Los Feliz History Matters When you walk the tree-lined streets of Los Feliz today, it’s easy to see why so many call it home. From historic estates and charming Spanish bungalows to trendy cafes and Griffith Park’s trails, Los Feliz offers a lifestyle that feels both timeless and m

Read MoreFAQ: Buying or Selling a Home in Los Feliz, Los Angeles CA 90027

FAQ: Buying or Selling a Home in Los Feliz, Los Angeles If you're thinking about buying or selling a home in Los Feliz, you're not alone. This iconic Los Angeles neighborhood offers historic charm, strong property values, and a lifestyle that’s hard to beat. Whether you're a first-time buyer or a lo

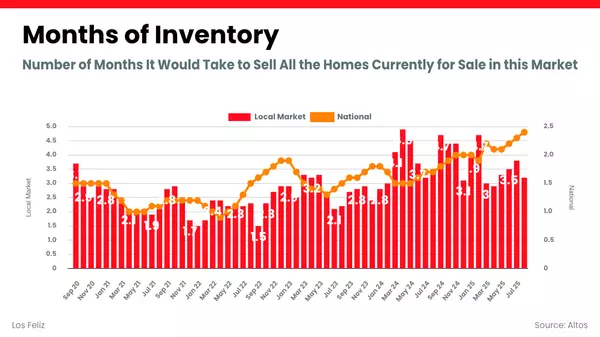

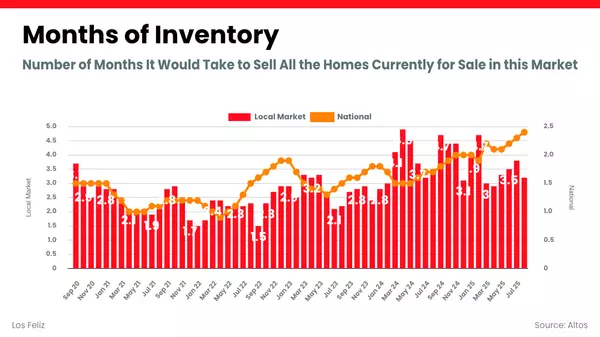

Read MoreLos Feliz Real Estate 2025 | Months of Inventory Rising

🏡 Months of Inventory in Los Feliz: What the Numbers Mean for Buyers & Sellers When it comes to understanding the real estate market, months of inventory is one of the most important indicators. It measures how long it would take to sell all the homes currently listed, assuming no new inventory ent

Read MoreWhat You Should Know About Getting a Mortgage Today

If you’ve been putting off buying a home because you thought getting approved would be too hard, know this: qualifying for a mortgage is starting to get a bit more achievable, but lending standards are still strong. Lenders are making it slightly easier for well-qualified buyers to access financing,

Read MoreYour House Didn’t Sell. Here’s What To Do Now.

When your house doesn’t sell, it doesn’t just feel frustrating – it feels personal. You put time, money, and emotional energy into this move. You told your friends and family it was happening. And now that your listing has expired without a buyer? You’re left feeling stuck, and maybe even a little e

Read MoreWhen You Buy a Home with an HOA, You're Also Buying the HOA

If you fall in love with a home in a community governed by a homeowners association (HOA), don’t just focus on the home—you’re also buying into the HOA itself. 🏨 Sure, HOAs can be a huge plus. They often maintain beautiful landscaping, offer amenities like pools or gyms, and can help preserve your

Read MoreDon’t Let Student Loans Hold You Back from Homeownership

While everyone’s situation is unique, your goal may be more doable than you realize. Plenty of people with student loans have been able to qualify for and buy a home. Let that reassure you that it is still possible, even as a first-time buyer. And just in case it’s helpful to know, the median studen

Read MoreTop 10 Most Googled Questions by First-Time Homebuyers in Los Angeles (2025)

Thinking about buying your first home in Los Angeles? You’re not alone. Every day, thousands of local renters and aspiring homeowners are turning to Google with the same questions you might be asking. In this blog, we break down the top 10 search questions trending right now—plus easy-to-understand

Read More-

This graph shows how inventory has changed compared to last year (blue bars) and compared to 2017–2019 (red bars) in different regions of the country. The South and West regions of the U.S. have seen big jumps in housing inventory in the past year (that’s the blue on the right). Both are almost back

Read More House Hunting Just Got Easier – Here’s Why

For anyone who’s been waiting for more choices, this is exactly what you’ve been hoping for – because more homes coming onto the market means more options and a better shot at finding one that fits your needs. To make sure you don't miss out on any of the latest listings for your area, lean on a loc

Read MoreSelling Before 2 Years? Here's What You Need to Know About Capital Gains Tax in California

Imagine This… You’ve just bought your dream home—keys in hand, heart full of excitement. The paint is still fresh, and the boxes are barely unpacked. You picture holidays in the living room, lazy Sundays in the backyard, and maybe even building equity over the years to come. Everything feels settled

Read MoreBuying a Fixer-Upper? How a 203(k) Loan Can Help You Finance Renovations

IntroductionAre you dreaming of homeownership but finding that move-in-ready homes are out of reach? Buying a fixer-upper can be a smart and affordable way to secure a property in a competitive market. However, one of the biggest challenges buyers face is financing the necessary renovations. That’s

Read MoreWhy Every Trust Attorney Needs an Agent Like Us: A Story of a Car, a Challenge, and a Happy Client

In the world of trust and probate sales, every case comes with its own unique set of challenges. Some are straightforward real estate transactions. Others? Well, they require a little extra finesse, a strong network, and the ability to handle the unexpected. Case in point: A recent call from one of

Read MoreSeller Concessions: A Smart Strategy To Get Your House Sold

✨ For the past few years, it’s been mostly a seller’s market. But dynamics are shifting as the number of homes for sale grows 🏡↑. That means the market is balancing out a bit. As a result, some sellers are finding they need to be more flexible to close a deal. One strategy that can help? Offering

Read MoreTop 3 Challenges Attorneys Face with Trust Clients – And How a Real Estate Expert Can Help

Attorneys handling trust clients often face challenges that a knowledgeable real estate agent can help solve. Here are the top three: 1️⃣ Managing Property Sales with Multiple Beneficiaries Challenge: When multiple heirs or beneficiaries are involved, disagreements over the sale price, timeline, or

Read MoreWhy Trust & Probate Attorneys Should Partner with a Real Estate Agent

Why Trust & Probate Attorneys Should Partner with a Real Estate Agent Probate and trust attorneys handle complex legal matters, guiding families through emotionally and logistically challenging times. While their primary role is to navigate the legal aspects of estate administration, they often find

Read MoreAre You Asking Yourself These Questions About Selling Your House?

Some homeowners hesitate to sell because they’ve got unanswered questions that hold them back. But a lot of times their concerns are based on misconceptions, not facts. And if they’d just talk to an agent about it, they’d see these doubts aren’t necessarily a hurdle at all. If uncertainty is keeping

Read MoreThe Perks of Buying a Fixer-Upper

What’s a Fixer-Upper? A fixer-upper is a home that’s livable but requires some renovations. Think cosmetic updates like wallpaper removal and new flooring or more extensive repairs like replacing a roof or updating plumbing. While fixer-uppers need a little TLC, here’s why they may be worth consider

Read More

Categories

Recent Posts