Understanding Californias New CalHFA Forgivable Down Payment Loan Assistance Program

As a Realtor and Behavioral Scientist researching on behalf of our clients is always top of mind.

I was recently asked by one of our buyer clients "what can you tell me about the 10% down payment assistance program?" What I knew was very little so I put my researcher hat on and went to work.

Here is what I found out when I went onto the CalHFA website.

After opening up the home page and reading thoroughly through the content, I went to the CalHFA preferred loan officers site. I knew I had to talk to the source! I called through the list of lenders until I found a lender that would speak to me.

Juan Rivera, one of the lenders at Golden Empire Mortgage was very informative and walked me through the scenario I am about to share with you below.

The 10% down payment is forgivable when you qualify based on specific criteria and use one of CalHFA preferred lenders.

Juan communicated with me that the big "challenge" of being approved for this program is the ability to purchase in the area where you are looking to live. The loan will have a limit based on a debt to income ratio of 45% not including any other debts such as car payements, credit cards, etc.

Let's walk through this example together (I'm going to assume you have visited the site and are familiar with the basic qualifications listed, first time buyer etc.).

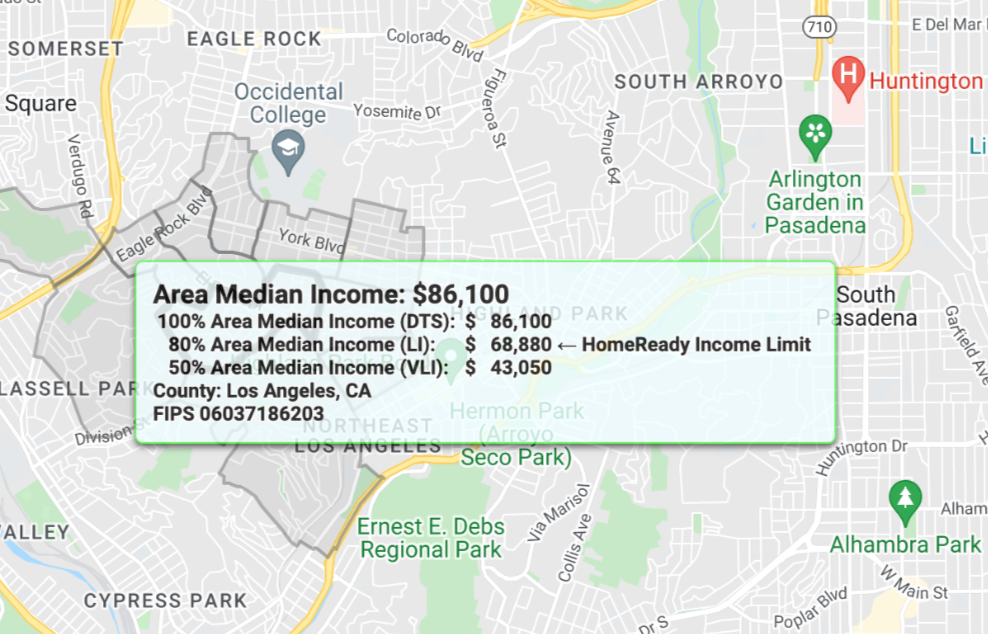

1. A map is provided to conduct a search of the area you are looking to buy in. In Los Angeles, the maximum median income is $68,880 (See search example below).

(retrieved from https://ami-lookup-tool.fanniemae.com/amilookuptool/)

2. We would take the income amount ($68,880, the low income area median approval amount not to exceed) and divide by 12 months = $5,666.67/month income.

3. The debt to income ratio for the CalHFA loan is a 45% debt to income ration = $5666.67 x 45% = $2,550

4. You would then minus all debts from the $2,550 (car payment, credit cards etc.) Let's say you have $500.00 a month in debts = 2550-500 = $2000

5. Your approximate mortgage payment would now be $2,000 approving you for a loan amount at $250,000.

6. Current program interest rates are at 5.75-6.25%

Next you are ready to look for your new home valued at $250,000.

This is where the challenge comes in. If your expectation is to purchase a home in Los Angeles or any other neighboring city, you can only purhcase up to $250,000.

If you have any questions please connect with us or our preferred lenders who are always here to help and answer any of your quesitons.

Until next time, please keep sharing your quesitons and we will find the answers to best guide you.

It's what we do best. 🤓

Categories

Recent Posts

Ultimate Guide to Living in Los Feliz, Los Angeles

Selling Before 2 Years? Here's What You Need to Know About Capital Gains Tax in California

Buying a Fixer-Upper? How a 203(k) Loan Can Help You Finance Renovations

Why Every Trust Attorney Needs an Agent Like Us: A Story of a Car, a Challenge, and a Happy Client

Seller Concessions: A Smart Strategy To Get Your House Sold

Top 3 Challenges Attorneys Face with Trust Clients – And How a Real Estate Expert Can Help

Why Trust & Probate Attorneys Should Partner with a Real Estate Agent

Are You Asking Yourself These Questions About Selling Your House?

The Perks of Buying a Fixer-Upper

Disaster Resources | Your Light at the End of the Tunnel