How Will The 2024 Election Affect the real estate market?

Dear Buyers and Sellers,

As you know Rooster Homes uses data to deliver content that answers the leading questions we are hearing from you. With an election approaching there is a lot of uncertainty and confusion around making the right decision regarding your real estate goals. Should I buy now, should I sell now, how can I make the best decision?

In this blog post, we hop into our real estate time machine and look at the previous election years. Come on this journey with me and I will show you how during times of certainty, leveraging historical data can help you accomplish your goals.

Presidential elections or election years affect the national housing market and mortgage rates through three related channels: uncertainty, policy expectations, and consumer confidence. These three channels lead to consumers choosing to possibly postpone a major purchase or sale until they gain greater confidence in the country's direction.

Let's review the data together and look at what happened across three critical metrics: Home Sales, Home Values, and Interest Rates. These metrics will provide insight that will increase your confidence in making an educated decision about how to enter this year's housing market with a plan.

With each metric, I will offer some insights on what we can anticipate given the data.

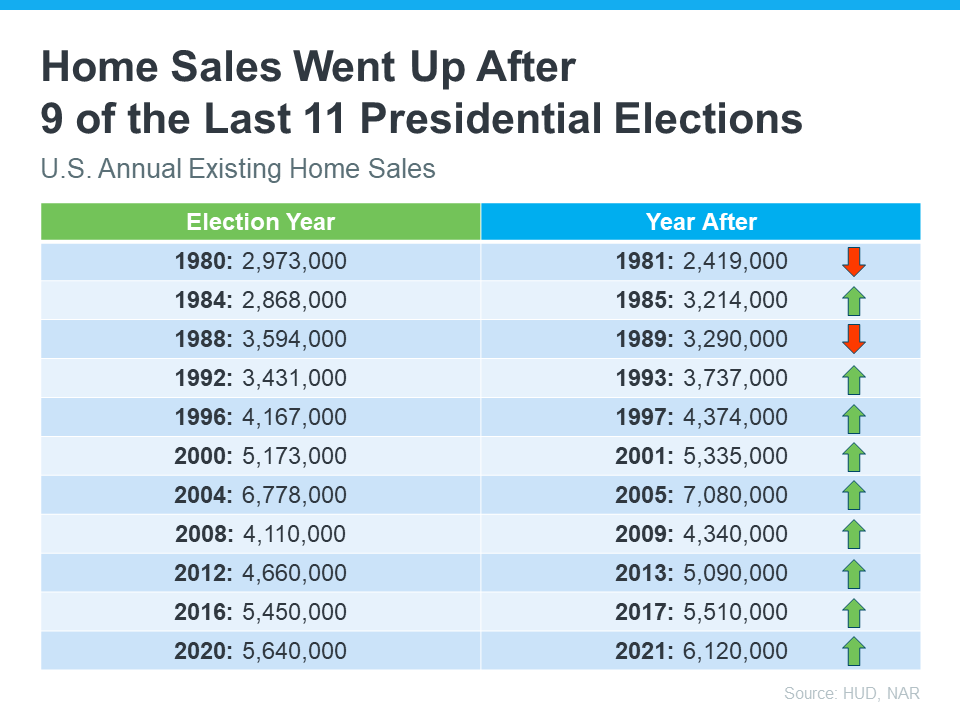

Figure 1: Data show in the last 9/11 years, in the year immediately following a presidential election year, home sales went up.

Figure 1: Data show in the last 9/11 years, in the year immediately following a presidential election year, home sales went up. Following an election year home sales are predicted to go up. Those buyers and sellers who remain uncertain may find themselves in a more competitive market. For buyers, there may be more buyer competition during the home search.

Figure 2: Data show in the last 7/8 years, in the year immediately following a presidential election year, home prices went up.

Figure 2: Data show in the last 7/8 years, in the year immediately following a presidential election year, home prices went up. If we refer to the most recent 2020 election year, home prices jumped up 18% the following year in 2021.

Let's go through the last 7 years together and calculate the average increase in sales prices.

1992-1993 = 3.41%

1996-1997 = 5.2%

2000-2001 = 6.31%

2004-2005 = 12.19%

2012-2013 = 11.39%

2016-2017 = 5.64%

2020-2021 = 18.2%

Average across the past 7/8 years = 8.9%

If we use the average home sales increase in the year immediately following an election year, it's fair to predict that we may expect an 8.9% increase next year in home sales prices. This will of course vary on some factors such as location and the type of home, but I think it's a fair and conservative assessment of what we can expect. In addition to this, our last metric revolves around interest rates, and with the anticipation of a drop in rates, we may experience an increase of over 8.9%.

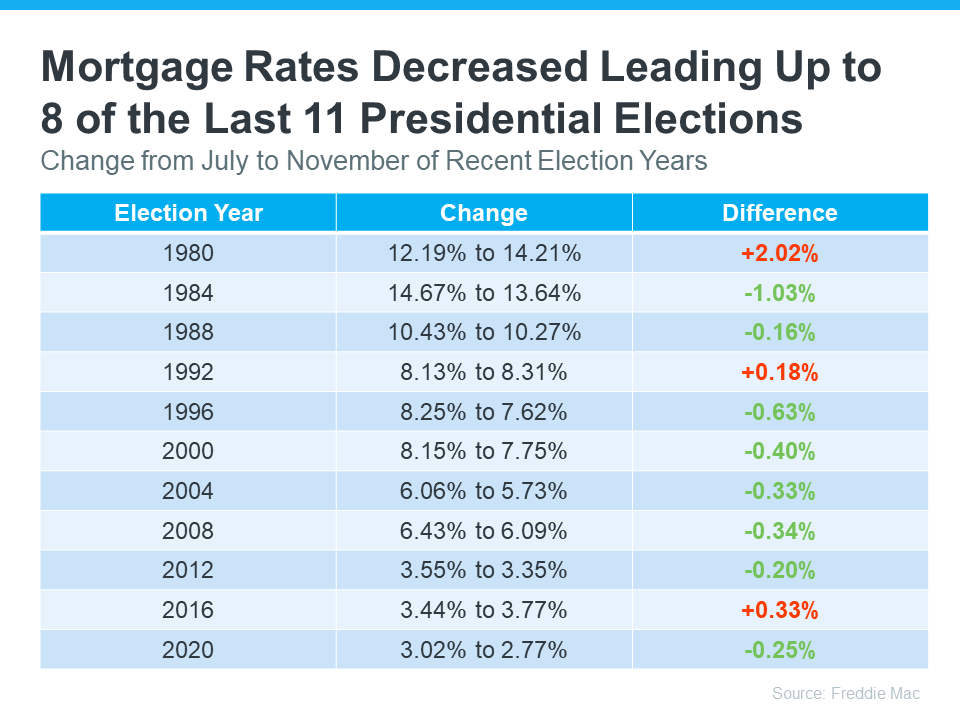

Figure 3: Data show in the last 8/11 years, in the year leading up to the presidential election, mortgage rates decreased.

Figure 3: Data show in the last 8/11 years, in the year leading up to the presidential election, mortgage rates decreased. This is hopefully not news to you readers. Many buyers are becoming more savvy and staying in tune with where rates are currently standing at any given point in time. Brandon and I keep a tight watch and lean into our lender resources to make sure we stay up to date on rate decreases.

As rates continue to decline we will see more and more buyers jump back into the market to purchase a home at an affordable price. We are seeing a couple of strategies with this expectation:

1. Some lenders are offering adjustable rate mortgages, 2-1 buy-downs, and other strategic programs, planning to refinance the loan once rates drop. This way buyers could enter the market now, before the anticipated return of more buyers, and refinance out of their rate, locking in a lower rate.

2. When the opportunity presents itself we are utilizing an offer strategy of asking for seller credits to help our clients buy the rate down. This means that when we submit an offer, we may ask for 25k back in seller credits at closing so our buyers can utilize those funds to buy their interest rate down. This is just an example.

With these three factors to consider; home sales, home prices, and interest rates, data can be your ally in making an educated and informed decision that is best for you and your family. We always tell our clients, it has to be the right decision for you and your family.

Let's connect and explore these data together and what strategies might make the most sense if you are on the fence about how to make a move during an election year!

Categories

Recent Posts

Scoops, Smiles & Community Spirit: Our Ice Cream Social Fundraiser for LAFD Station 35!

Supporting Our Heroes: Fire Station 35 Fundraiser in Los Feliz | Rooster Homes Cares

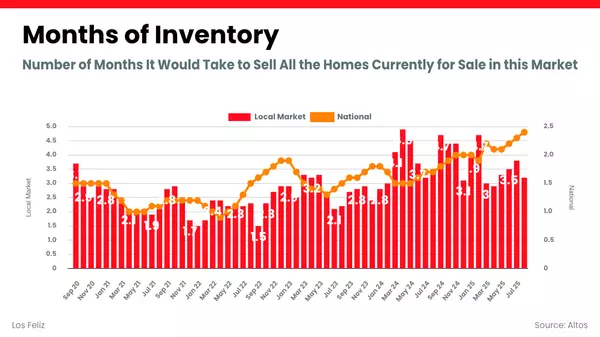

Los Feliz Real Estate 2025 | Months of Inventory Rising

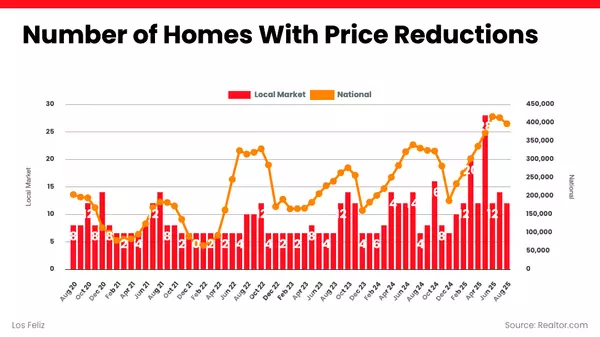

Number of Homes With Price Reductions in Los Feliz: What the Data Reveals

Los Feliz Landmarks: Must-See Spots in the Neighborhood

Family-Friendly Activities in Los Feliz: Parks, Museums, and More

Historic Architecture in Los Feliz: From Spanish Revival to Mid-Century Modern

Shopping in Los Feliz: Boutiques, Vintage, and Everyday Essentials

Schools in Los Feliz: Top-Rated Options for Families

Art and Music in Los Feliz: Local Galleries, Studios, and Venues